Federal Credit Union: High Quality Financial Services and Support in Wyoming

Cooperative Credit Union: Your Course to Better Financial

In the realm of contemporary financial, Lending institution stand apart as a sign of tailored community-centric values and economic remedies. Their special method to financial exceeds the traditional version, providing participants a path to far better monetary health with affordable rates and customized services. By promoting a feeling of belonging and prioritizing private needs, Cooperative credit union have actually redefined the financial experience. However what establishes them apart in today's affordable landscape?

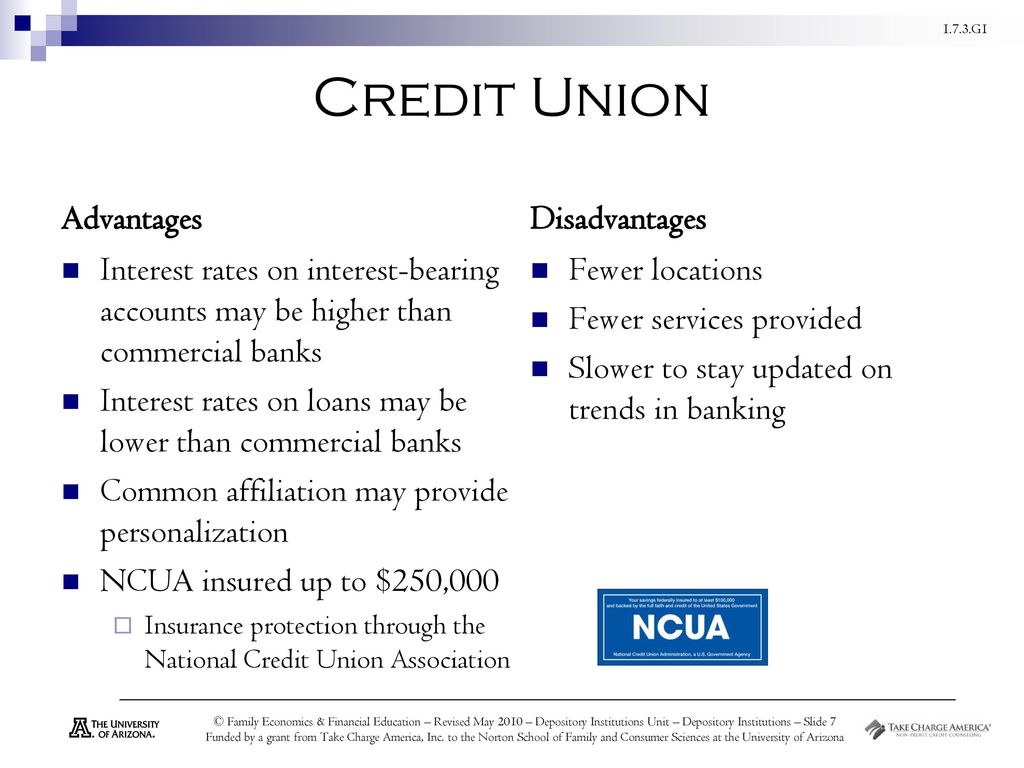

Advantages of Lending Institution

Debt unions supply an array of benefits that set them apart from typical financial institutions in terms of customer solution and community participation. Credit unions are not-for-profit organizations, meaning they focus on supplying competitive prices on financial savings accounts, fundings, and credit rating cards for their participants.

In addition, cooperative credit union are deeply rooted in the areas they offer. They often engage in neighborhood outreach programs, enroller local occasions, and support philanthropic causes. By cultivating these connections, cooperative credit union add to the economic development and advancement of their neighborhoods.

In addition, lending institution normally have lower costs and provide far better rate of interest rates contrasted to traditional financial institutions. Participants frequently take advantage of reduced lending rates of interest, greater returns on interest-bearing accounts, and reduced or no charges for solutions like examining accounts or ATM withdrawals. This monetary benefit can bring about significant long-lasting financial savings for members.

Personalized Solution

With an emphasis on customized focus and customized financial options, members of credit unions take advantage of a high degree of personalized service. Unlike conventional banks, lending institution focus on constructing solid partnerships with their members by comprehending their distinct financial needs and objectives. This tailored strategy enables cooperative credit union personnel to supply tailored suggestions, referrals, and services that align with each participant's details circumstance.

One secret aspect of tailored solution at cooperative credit union is the access of team member. Participants commonly have straight access to decision-makers and monetary consultants, cultivating an extra responsive and individual financial experience. Whether a member requires assistance with a funding application, monetary planning, or settling a concern, lending institution team are readily offered to use assistance and support.

Furthermore, lending institution make every effort to go past transactional interactions by establishing trust and relationship with their members (Credit Unions in Wyoming). By learning more about individuals on a personal degree, lending institution can much better offer their financial needs and use tailored solutions that aid participants attain their goals. This commitment to individualized solution sets lending institution apart and creates a more helpful and interesting financial partnership for participants

Affordable Prices

In today's affordable economic landscape, debt unions use participants appealing rates that can enhance their overall financial experience. Unlike typical financial institutions, credit unions are not-for-profit companies possessed by their participants, allowing them to concentrate on giving affordable rates rather than optimizing revenues. This special framework allows lending institution to offer reduced rate of interest rates on car loans, greater rates of interest on financial savings accounts, and fewer costs contrasted to many large banks.

Affordable prices are a considerable benefit for credit rating union participants when seeking financial items such as mortgages, auto finances, or bank card. By supplying lower rate of interest, cooperative credit union assist members conserve money over time and attain their monetary goals extra effectively. Furthermore, the higher rates of interest on interest-bearing accounts allow members to expand their cash much faster and enhance their cost savings potential.

Community-Focused Efforts

Moreover, lending institution commonly take part in philanthropic tasks that attend to certain demands within the neighborhood. Whether via donations, sponsorships, or volunteer work, credit unions demonstrate their dedication to making a favorable effect beyond just economic solutions. These efforts not just enhance the bond in between the lending institution and its participants however likewise cultivate a sense of solidarity and collaboration among neighborhood members. Ultimately, community-focused campaigns embody the participating her explanation spirit of lending institution, emphasizing their dedication to social duty and regional empowerment.

Boosted Financial Experience

An Enhanced Financial Experience distinguishes credit report unions by prioritizing individualized services customized to fulfill the distinct financial demands of their participants. Unlike traditional banks that often concentrate on profits, credit unions put a strong emphasis on participant satisfaction and monetary wellness. This individualized strategy allows credit report unions to use a variety of advantages that improve the general banking experience for their participants.

One trick aspect of a Boosted Financial Experience is the concentrate on building strong connections with participants. Debt union personnel often make the effort to comprehend each member's individual economic objectives and challenges, offering customized guidance and assistance to aid them make educated choices. This customized touch produces a feeling of count on and commitment in between the cooperative credit union and its members, cultivating a resilient partnership.

In addition, cooperative credit union often provide affordable rates on finances browse around here and savings items, aiding participants save cash and achieve their economic goals much faster. The emphasis on participant service and fulfillment sets credit report unions apart in the financial market, making them a recommended choice for people seeking an extra individualized and satisfying banking experience.

Conclusion

Credit history unions are not-for-profit companies, meaning they prioritize supplying competitive prices on savings accounts, fundings, and credit score cards for their members.Competitive prices are a considerable advantage for credit score union participants when looking for monetary items such as home loans, vehicle loans, or debt cards. By offering workshops, seminars, and sources on topics like budgeting, saving, and debt building, credit rating unions actively add to the economic wellness of family members and people.

These initiatives not just reinforce the bond between the credit score union and its participants but also foster a sense of solidarity and teamwork among community members. By focusing on participant fulfillment and providing customized monetary solutions, Credit scores Unions demonstrate a commitment to empowering their participants and constructing solid, trust-based relationships.